New Delhi: In the wake of a recent investor meet that underscored the demerger of ITC hotels as ITC’s commitment to sharper capital allocation, analyst firms have taken note and have subsequently posteda positive target price for the company.

The company expects ROCE to increase by 18 to 20 percent across business segments, and double digit (10 per cent) improvement in its ROIC (Return on Invested Capital).

Analyst firm Nuvama perceives this demerger as hugely positive and maintains a SoTP-based target price of Rs 560. It sees the demerger as a huge value unlock for the new entity and 40 per cent stake that ITC will hold will ensure the much-needed flexibility, while the new entity will continue to have all the strategic support from ITC Ltd, adding to the comfort of stakeholders.

The demerger arrangement of ITC presents a well-balanced structure that reiterates the brand’s commitment to enhanced capital allocation effectiveness.

Under the proposed plan, the hotel entity will have the autonomy to manage its own capital requirements providing the headroom for growth to the hotels business.

With ITC retaining a 40 per cent ownership stake in the demerged Hotel Business and the remaining 60 per cent to be held by ITC shareholders, the arrangement ensures synergies and stability for the new entity.

This strategic decision allows ITC to continue benefiting from potential growth while empowering the demerged Hotel Business to operate with increased independence.

Analysing the future course of the demerged entity, analyst firm Prabhudas Lilladhar also continues its positive outlook for the brand. It expects the new entity to have close to Rs60bn of net assets with zero debt.

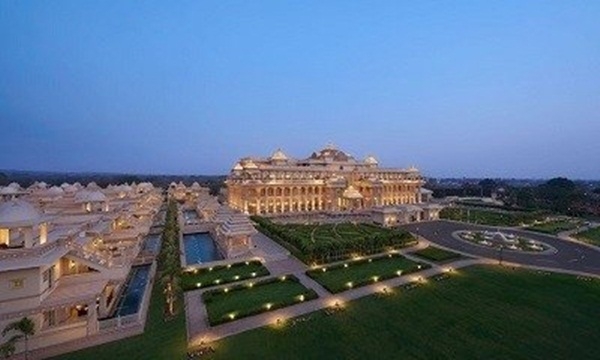

It can leverage its balance sheet to raise capital over and above cash flows it generates and will be able to attract investors given its strong hotel assets, market standing, service excellence, cuisine expertise and synergies associated with ITC Ltd.

By maintaining its ownership stake, ITC will empower the new entity to achieve accelerated growth, instilling a sense of assurance among partners, investors, and employees while ITC’s significant stake sends a positive signal, showcasing the company’s unwavering dedication to the success of the new entity.

ITC believes that the hotels business is strategically positioned to implement its asset rights strategy and achieve rapid growth. With a strong and debt-free balance sheet supported by substantial assets, the new entity has abundant resources to fund its asset right initiatives.

With its positive cash flow and profitability, the new entity possesses the flexibility to effectively raise capital if needed.

Additionally, it has the option to explore equity-based fundraising or attract potential investors keen on collaborating with the business.

–IANS

Comments are closed.