Mumbai: Asset manager SBICAP Ventures Ltd on Tuesday announced investment in climate-tech company Solinas, which provides robotic and AI solutions for the water and sanitation industry, but did not disclose the sum.

The investment was made via the Neev II Fund, managed by SBICAP Ventures which is a State Bank of India (SBI) group company.

Established in 2018, Solinas provides solutions with a focus on detecting defects and leakages in water and sewer pipelines, assessing their condition, and eliminating manual scavenging through mechanised cleaning of manholes and septic tanks.

“This aligns with the country’s vision of providing clean water and sanitation to every household. Our support for this transformative initiative, through Neev II Fund, also aims to empower the sanitation workers in India,” said Suresh Kozhikote, MD and CEO, SBICAP Ventures.

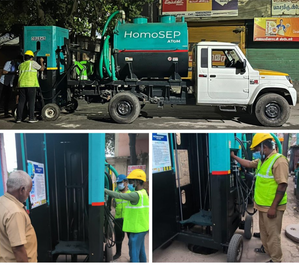

Solinas has three major products under its portfolio with multiple patents – Endobot, Swasth AI, and HomoSEP.

Endobot is a crawler robot designed for internal condition assessment and defect detection in water, sewer and drainage lines. It is enhanced by Swasth AI, an AI-based digitisation platform storing and analysing all the data collected by Endobot.

HomoSEP is a robot designed to completely clean manholes and septic tanks, said the company.

“We are committed to innovate within the water and sanitation issues across all industries,” said Divanshu Kumar and Moinak Banerjee, Founders, Solinas.

Nicola Beer, Vice-President of the European Investment Bank (EIB), said they welcome the NEEV II fund’s investment in Solinas.

“The funding of Solinas is aligned with the European Union’s Global Gateway initiative, supporting sound projects that improve global and regional connectivity in the digital, climate, transport, health, energy and education sectors,” said Beer.

The Neev I Fund and Neev II Fund are supported by global and domestic investors such as the EIB, the UK government, SIDBI, JICA, SRI Fund, and SBI Group.

–IANS

Comments are closed.